The Southern African Power Pool (SAPP) is the most mature of the power pools established in Africa. SAPP was established in 1995 and, while progress has been gradual, SAPP does act as a platform for electricity trading across the region. This includes a competitive day-ahead market. None of the other power pools has a relatively, transparent and competitive market of this type.

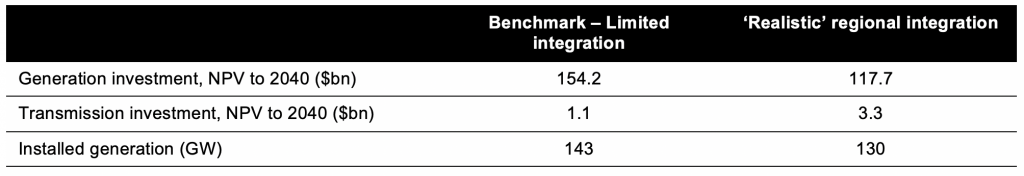

The 2017 SAPP Pool Plan provides an indication of the benefits of effective electricity trade across the region. The Plan presents the likely quantum of generation and transmission investments required across the region between now and 2040. This modelling suggests that ~13 GW less generation capacity would be required if a regional approach is taken to optimising planning, compared to simply aggregating national plans. This could save ~$34bn in NPV terms.

Source: SAPP (2017)

The benefits of electricity trading can be significant:

- System size – economies of scale can be realised through optimising investment across a bigger market, as illustrate in the SAPP Pool Plan numbers above.

- Operating efficiency – trading cross border can help to tackle system operation challenges. This can include both short-term optimisation (e.g. renewables integration) and long-term diversification of supply options, improving climate resilience in a region where hydro has an important role.

- Market structure – resilient infrastructure and market mechanisms for regional trade can act as a catalyst for price transparency and domestic energy sector reforms, unlocking a wide range of secondary benefits.

These benefits in turn can help to drive outcomes that are aligned with other DFID priorities:

- More affordable power – as illustrated above, regional integration can reduce the cost of electricity supply, making power more affordable.

- Improved reliability and power quality – regional infrastructure, accompanied by investment at the national level, can help to improve system resilience.

- Reduced GHG emissions – regional integration can help to facilitate renewables integration, acting as an important tool in managing the system operations challenges associated with intermittent renewables.

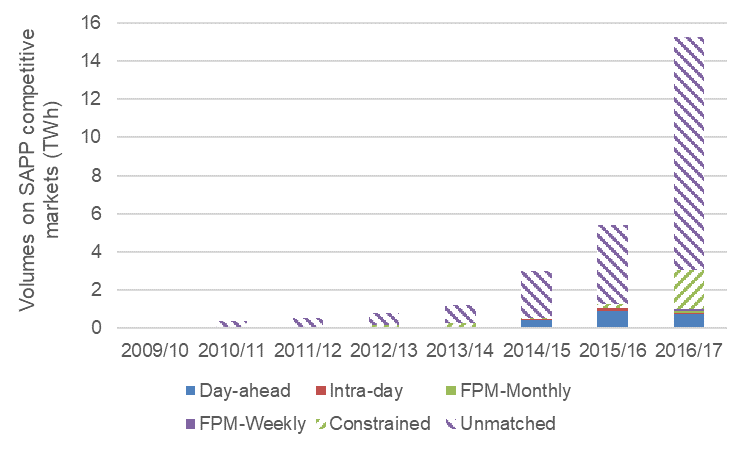

In spite of these benefits, growth in electricity trade across the region has been slow, and only accounts for ~3% of electricity supply. Electricity trade is heavily constrained, and the most important constraint on trade is the physical transmission infrastructure. A large portion of trades that are matched on SAPP’s trading platforms cannot be implemented because the physical transfer capacity either does not exist or is not available. Available capacity is also reduce by the dominance of bilateral trades between member state utilities, which reduces the availability of transmission capacity for the more transparent competitive markets.

Source: SAPP (2013-2017), Africa GreenCo (2017), ICED analysis

The barriers to electricity trade span DFID’s Whole System Approach[1]:

- Governance and regulation – at the national level a desire for self-sufficiency acts as a barrier to integration; planning activities at the national level are not joined up with regional initiatives.

- Market and commercial – the financial weakness of national utilities and a lack of transparency in national electricity market operations are barriers. Further, traditional business models for transmission investment are not fit-for-purpose in a future with high penetration of intermittent renewables.

- Physical infrastructure – as noted above, the binding constraint on electricity trade today is the lack of sufficient transmission capacity both within countries and cross-border.

Donors are already heavily involved in the electricity sector across the region. There has been a lesser (but growing) focus on electricity trading and related issues. The two largest relevant activities that we are aware of are:

- The Advancing Regional Energy Projects (AREP) initiative, which was seeded by a $20m IDA grant from the World Bank Group (WBG). To date AREP has been focused primarily on project preparation support but plans to tackle a wider range of issues through a new Multi-Donor Trust Fund (MDTF), which the Swedish International Development Agency (SIDA) has already committed funds to. There are significant potential synergies between some of the priorities identifies by this report and WBG’s proposals for the MDTF.

- The Southern African Energy Program (SAEP), which is part of US AID’s Power Africa initiative. SAEP’s activities have primarily been focused at the national level, but it has provided some capacity building support to regional institutions, as well as transaction advisory services to the Malawi-Mozambique interconnector project. Power Africa is built on partnerships and there may again be synergies and opportunities for cooperation when supporting individual transmission infrastructure projects in the region.

[1] DFID (2018): A Whole System Approach: a guide for DFID advisors engaging in the energy sector